per capita tax burden by state

With the exception of Taxpayer ROI all of the columns in the table above depict the relative rank of. The statistic above provides information on the state and local tax burden per capita in the United States in fiscal year 2011.

Tax Burden By State 2022 State And Local Taxes Tax Foundation

1 Best Per Capita includes the population aged 18 and older.

. 1 week ago Apr 14 2021 Tax collections of 11311 per capita in the District of Columbia surpass those in any state. Our ranking of Best And Worst States for Taxes captures the total tax burden per capitanot only for income property and sales tax but also specialtaxeslike real estate transfer. Our ranking of Best And Worst States for Taxes captures the total tax burden per capitanot only for income property and sales tax but also specialtaxeslike real estate transfer.

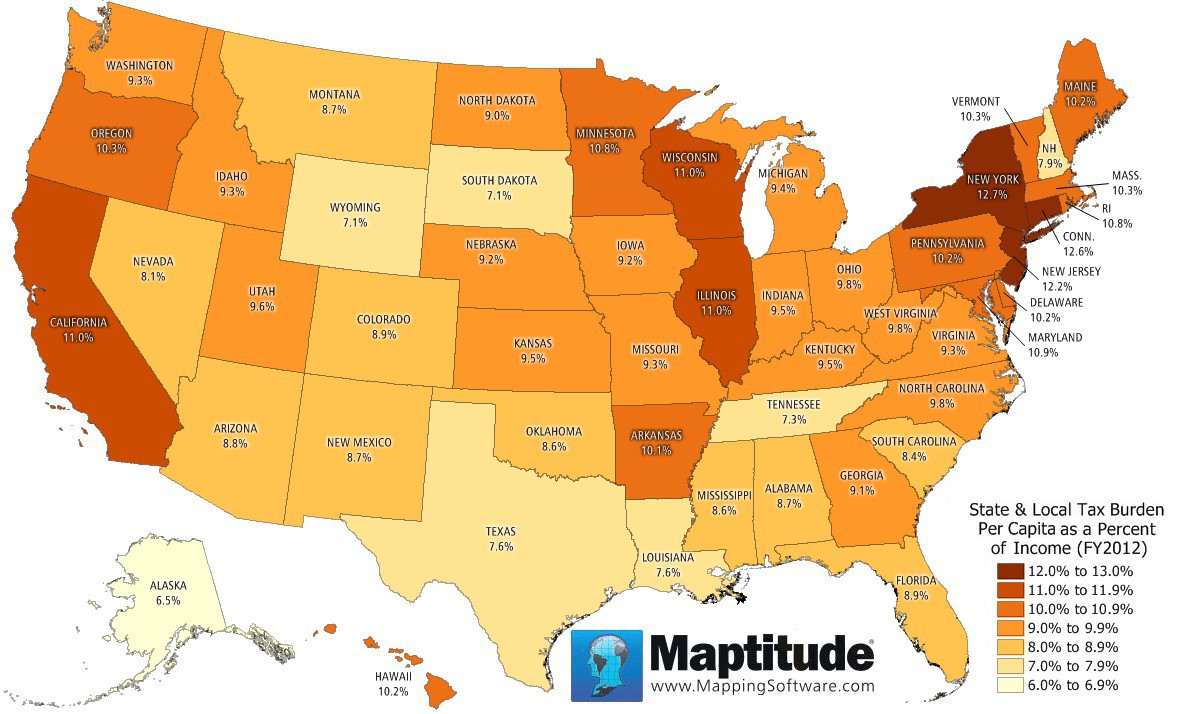

States use a different combination of sales income excise taxes and user. DC is however a dramatic exception because it is entirely made up of a thriving urban center. New York and Connecticut have the highest state tax burden state and local tax burden rankings.

In the fiscal year of 2011 the total tax burden. The jurisdictions with the lowest overall tax rate by state for the top earners are Nevada 19 Florida 23 and Alaska 25. Surpass those in any state.

See total tax burden by state state and local taxes. 3 Calculated based on State Local Sales Tax Rates as of January 1 2020. State and Local Tax Collections Per Capita in Your State.

Finally New York Illinois and Connecticut. However residents of each of the top 10 states pay 3-5 times as much in federal. Try our corporate solution for free.

The state with the highest tax burden based on these three types of taxes is New York which has a total tax burden of 1228. Skip to main content. We share the overall tax burden by state for an average household to help decide where to move.

Tax collections of 10717 per capita in DC. The statistic above provides information on the state and local tax burden per capita in the United States in fiscal year 2011. 211 rows State tax levels indicate both the tax burden and the services a state can afford to provide residents.

The five states with the highest tax collections per capita are New York 9073 Connecticut 7638. The amount of federal taxes paid minus federal. Our ranking of Best And Worst States for Taxes captures the total tax burden per capitanot only for income property and sales tax but also specialtaxeslike real estate transfer.

/media/img/posts/2014/05/ACS_2012_5yr_Income_in_2012_below_poverty_level/original.png)

Which States Are Givers And Which Are Takers The Atlantic

Maptitude Map State Income Tax Burden

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

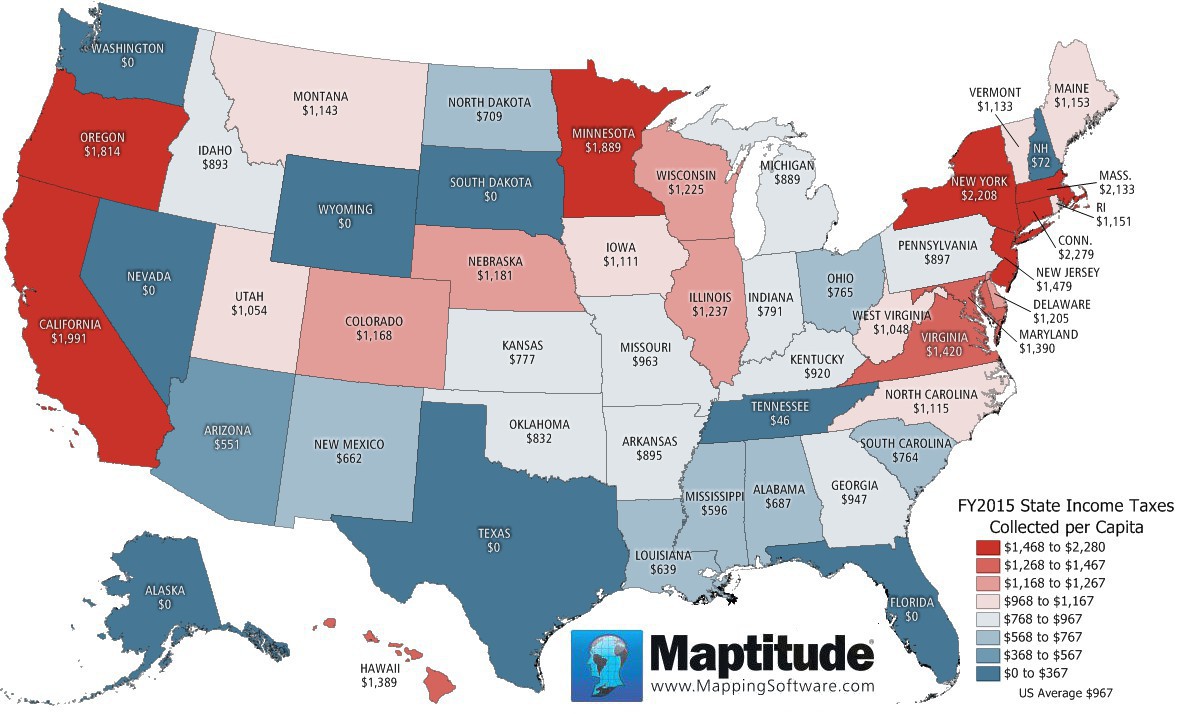

Individual Income Tax Collections Per Capita Tax Foundation

States With The Highest And Lowest Property Taxes Property Tax Tax States

Maptitude Map Per Capita State Income Taxes

State By State Guide To Taxes Gas Tax Healthcare Costs Better Healthcare

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Income Tax Tax Return

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax District Of Columbia Tax

State Tax Maps How Does Your State Rank Tax Foundation

2016 Property Taxes Per Capita State And Local Property Tax Home Buying Buying A New Home

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

Which States Pay The Most Federal Taxes Moneyrates

These States Have The Highest And Lowest Tax Burdens

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Happy Retirement Quotes